Helping you find answers

At Washington Trust, we've spent more than two centuries helping families through every chapter of life, and we understand that the journey feels more manageable when you have a trusted companion by your side.

That's why we created Age With Wisdom.

Think of it as your go-to resource for thoughtful guidance and practical tools to help you embrace the advanced years of life with confidence and grace. Whether you're simplifying day-to-day banking, exploring long-term care options, or mapping out legacy goals, we're here to help you turn "Where do we begin?" into "We can do this."

Most families find that thoughtful planning brings genuine peace of mind. Our banking, lending, and wealth-management specialists are ready to work seamlessly with your attorney, accountant, healthcare providers, and residential-care partners to create a holistic plan that protects well-being and honors wishes—both today and for years to come.

Let us help you—and the people you hold dear—age with confidence, comfort, and wisdom.

Wondering where to start?

Navigating the questions that come with aging can feel overwhelming. To make things easier, our Age With Wisdom team is here to listen and guide. No question is too small, and your outreach is never an imposition. Reach out anytime—we’re ready to help you find solutions that feel right for you and your family.

- Visit the Age With Wisdom Resource Center for videos, tips, worksheets and more!

- Stop by any Washington Trust branch and talk with a friendly banker.

- Call our Customer Solutions Center at 800-475-2265 to connect with an advisor who is eager to help.

- Contact Us to start a conversation.

Our integrated approach ensures you’ll never face these challenges alone.

A few thoughtful steps today means less scrambling and more peace of mind for everyone down the road.

Get your paperwork in order. Draft or refresh your will, powers of attorney, healthcare proxy, and any trusts so your loved ones have clear guidance when emotions are running high.

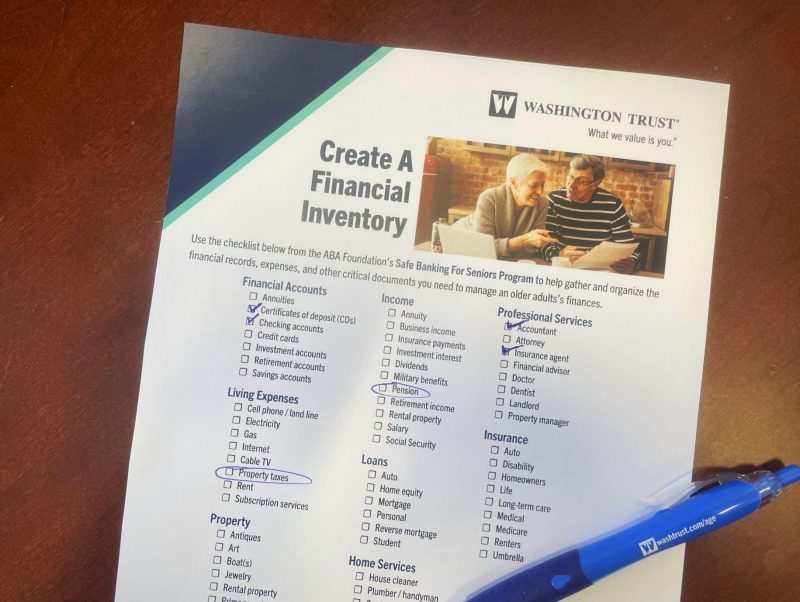

Create a simple "money map." A one-page list of every bank account, investment, insurance policy, loan, and regular bill becomes a roadmap for the people caring for your affairs. Store it safely and make sure your executor or trusted helper knows exactly where to find it.

Make daily finances effortless. Online banking and automatic bill payments mean your household keeps running smoothly even when you can't manage it yourself. Adding your power-of-attorney designee as a view-only user of your accounts lets them step in seamlessly if needed.

Keep your beneficiaries current. Take a moment to verify that life-insurance, IRA, and 401(k) designations still reflect your current wishes—these forms actually override your will, so they need to be right.

Build your family's support team. Washington Trust advisors can become your family's planning hub, working alongside your attorney, tax specialist, and caregivers to protect what you've built and honor your legacy. We're here to help with:

- Estate-plan reviews and recommendations

- Family meetings that keep everyone connected and informed

- Comprehensive financial plans that support every generation

- Tax-smart charitable-giving strategies

- Intergenerational gifting programs

For helpful worksheets, how-to videos, and planning checklists, visit our Age With Wisdom resource page.

Scammers target older adults because they know generosity and trust can be easy to exploit. With a few protective habits and the confidence to trust your instincts, you can keep yourself and your loved ones safe.

Never wire, gift card, or crypto. Real businesses and government agencies will never pressure you into these irreversible payments. If someone insists on them, it's your signal to walk away.

Keep your banking private. Never let a stranger "help" you log into accounts or move money around. Scammers use that moment of access to steal your information.

Trust your gut. When a caller, email, or text creates urgency around money or personal details, your discomfort is an alert to hang up or delete the message. Contact the company using a number you trust—from a recent statement or their official website—or simply call your Washington Trust banker.

Protect your personal world. Shredding old statements, using strong passwords, and keeping personal details off social media might feel like small steps, but they create powerful barriers against fraud.

Share the watching. If someone helps with your finances, review financial statements together so you have a second set of trusted eyes to catch anything unusual.

Absolutely. It's all about creating a safety net that brings peace of mind to everyone involved.

Put legal permission in place. Having an honest conversation about a financial power of attorney might feel uncomfortable, but it's a gift to your loved one. It means they can rest easy knowing someone they trust completely will be there to help if needed.

Review current accounts together. Consider scheduling a relaxed informational visit with a Washington Trust banker—think of it as a family planning session. We'll help you explore account ownership, beneficiaries, and features like view‑only access that make shared financial management feel natural and secure.

Go digital, with safeguards. Online and mobile banking become lifelines when you need to handle things from a distance. Setting up fraud alerts and transaction notifications means you're watching out for loved ones, even when you can't be there in person.

Create a "financial snapshot." A simple list of bills, due dates, and income sources becomes invaluable when you're juggling caregiving responsibilities. Keep it somewhere safe and share the location with anyone else who might step in to help.

Keep the conversation going. These money conversations get easier with practice, and regular check‑ins help everyone feel heard and understood. You're building trust and identifying issues before they become problems.

Simply by asking the question, you are taking a loving first step. Caring for an aging parent can feel daunting, but breaking it into small conversations and simple action items makes the path clearer. Here are a few helpful guideposts:

Start with heart-to-heart conversations. Sit down with your parents (and any siblings or close relatives) to openly discuss money matters, their wishes for care, and who feels comfortable helping with what. Beginning these conversations prior to any crisis allows everyone to feel heard and ensures your parents' preferences remain at the center of all decisions.

Understand their current financial picture. Gather the essential information: income sources, savings, monthly expenses, and any debts. Having a clear picture helps you see what's working well and what areas might benefit from adjustments—all while respecting their autonomy.

Think ahead with compassion. Consider future needs like medical expenses, home modifications, or a potential transition to assisted living or long-term care. Planning together for these possibilities helps reduce stress and ensures your family won't be caught off guard by unexpected challenges.

Explore available support systems. Review Medicare, Medicaid, supplemental insurance, Social Security, veterans' benefits, and disability programs—any resources that can help provide care and financial support. Understanding what's covered (and what isn't) helps you plan more confidently.

Keep important documents current. Ensure wills, powers of attorney, and healthcare directives reflect your parents' current wishes. If the legal aspects feel intimidating, an elder-law attorney can help translate complex language and provide reassurance for the whole family.

Need a handy document checklist or more caregiver tips? Visit our Age With Wisdom resource page anytime.

Adding beneficiaries is one of the easiest ways to ensure money goes exactly where your loved one wants it to. And by keeping assets out of a lengthy probate process, beneficiary designations spare the family unnecessary paperwork, stress, and expense.

Choose the people. Talk to your loved one about who should be designated for each account and why these choices matter to them. Understanding their reasoning helps honor their wishes and prevents confusion later.

Add beneficiaries to every eligible account. Most financial institutions make this surprisingly simple—it often takes just a few minutes to add a POD (Payable on Death) or TOD (Transfer on Death) designation to:

- Bank accounts

- Investment accounts

- Retirement plans (401(k), IRA)

- Life insurance policies

Align with the estate plan. Ensure beneficiary choices line up with wills, trusts, and other planning documents, so everything reflects your loved one’s intentions.

Keep information current. Life brings changes—new marriages, grandchildren, shifting relationships. A gentle annual conversation about whether designations still feel right shows you're paying attention to what matters most.

Store copies safely. Keep beneficiary forms where you and other trusted family members can easily find them when needed.

For more estate-planning guidance, visit our Age With Wisdom resource page.

There's something deeply comforting about aging in the place you know and love. With thoughtful planning now, you can keep your home safe and affordable for many years to come.

Do a "home-for-life" walkthrough. Take a tour through your space, imagining how small changes could make a big difference—grab bars in your shower, better lighting, perhaps a stair-lift that keeps your whole home accessible in the future. An occupational therapist or certified aging-in-place specialist can offer wonderful insights.

Get comfortable with the numbers. Understanding the costs of improvements and ongoing care helps you plan with confidence, knowing exactly what you're working toward.

Explore financing that fits your life. Our Washington Trust lending team can help you turn your home's equity into the foundation for staying put. We'll walk you through options like:

- Home-equity loans or lines of credit

- Traditional or adjustable-rate mortgages

- Reverse mortgages (for homeowners 62+)

- Securities-based lines for added flexibility

Build your support network. Connect with licensed contractors, reliable handypersons, and caring home-health providers who truly understand aging-in-place needs.

Make daily life effortless. Set up online bill pay and automatic transfers so day-to-day finances run smoothly, giving you more time to enjoy the home you love.

A medical crisis can turn life upside-down in minutes. After attending to your loved one’s immediate medical needs, take a few focused steps to protect their financial well-being and honor their wishes.

Gather the important paperwork. Look for wills, powers of attorney, trusts, account statements, and insurance policies. Creating a simple list beforehand helps ensure nothing gets overlooked.

Find out who can legally help. Check for a power of attorney, joint-account owner, or successor trustee who can step in immediately. If no one was designated, an elder-law attorney can guide you through guardianship or conservatorship options.

Secure everyday finances. Arrange for essential payments—mortgage, utilities, insurance—to be made from an authorized account. Washington Trust can help set up temporary safeguards and verify who has access to accounts at our bank.

Protect cash and property. Freezing or monitoring debit and credit cards, securing valuables, and updating online-banking alerts help shield your loved one from financial harm when they're most vulnerable.

Accept trusted support. Bankers, financial advisors, and elder-law attorneys understand these situations and can quickly untangle complex questions, freeing you to focus on what matters most—being there for your loved one. If you're not sure where to begin, please call us.

For legal-preparation tips and more caregiver support, visit our Age With Wisdom resource page.

Absolutely—because estate planning is really about taking care of the people you love, no matter how much or how little you have. Even simple checking and savings accounts can create unexpected stress for your family if something happens to you. A few thoughtful documents ensure your wishes will guide every outcome.

Name the people who'll step in for you. A durable power of attorney lets someone you trust handle money matters; a healthcare proxy ensures the right person speaks for you on medical decisions if you can't.

Put your wishes in writing. A simple will covers your personal belongings and any guardianship preferences; a revocable living trust can add privacy and flexibility if that feels right for your situation.

Keep documents safe but accessible. Store originals in a fire-safe box or with your attorney, and make sure your trusted loved ones know exactly where to find them.

An elder-law or estate-planning attorney can tailor these documents to fit your family's unique needs. For more planning guidance, visit our Age With Wisdom resource page anytime.

For more than 200 years, Washington Trust has been the place where families feel comfortable asking any question, big or small.

Stop by any branch: There's something reassuring about sitting down face-to-face with a banker who takes the time to understand your situation and help you find solutions.

Give us a call: Our Customer Solutions Center advisors are ready to listen and guide you through whatever is on your mind. Reach us at 800-475-2265.

Send us an email: Drop us a note—whether it's a quick question or a description of your situation, we want to hear from you.

Explore at your own pace: Our Age With Wisdom resource page is filled with articles, videos, and planning tools you can dive into at your convenience.

No matter how you choose to reach out to us, caring Washington Trust advisors are genuinely invested in helping you and the people you love move forward with confidence, love—and wisdom.

Featured Video

Visit our Age with Wisdom™ Resource Center for more videos, tips, worksheets and information!

Contact Us Anytime

Deposit accounts, home equity lines of credit, and securities-based lending are offered by The Washington Trust Company, Member FDIC, Equal Housing Lender, NMLS #414726

Washington Trust Mortgage Company LLC is a subsidiary of the Washington Trust Company, of Westerly; Equal Housing Lender, NMLS #901927; MA Mortgage Broker License #MC901927, MA Mortgage Lender License #MC901927, RI Lender License #20122863LL, RI Loan Broker License #20122864LB, NH Mortgage Banker License #901927MB. For Reverse Mortgage: We arrange but do not make loans. MORTGAGE BROKER ONLY, NOT A MORTGAGE LENDER OR CORRESPONDENT LENDER. This material is not provided by, nor is it approved by the Department of Housing & Urban Development (HUD) or by the Federal Housing Administration (FHA). You should consult your benefits specialist, or financial advisor as Reverse Mortgage payments may have an effect on your particular situation. Reverse Mortgages are brokered through Washington Trust Mortgage Company only.

Washington Trust Wealth Management® is a registered trademark of The Washington Trust Company, which has licensed its use to its parent, affiliates, and subsidiaries, including Washington Trust Advisors, Inc. Investment products are offered through Washington Trust Wealth Management. Non-deposit investment products are: Not deposits; Not FDIC insured; Not insured by any federal government agency; Not guaranteed by the Bank; May go down in value. This material is presented solely for informational purposes, and nothing herein constitutes investment, legal, accounting, actuarial or tax advice. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon and is not, and does not constitute, a public or retail offer. It is important to remember that investing entails risk.

Age with Wisdom™ Resource Center

Have questions? We can help.

Visit our Age with Wisdom™ Resource Center for more videos, tips, worksheets and information!