Should you Move or Improve?

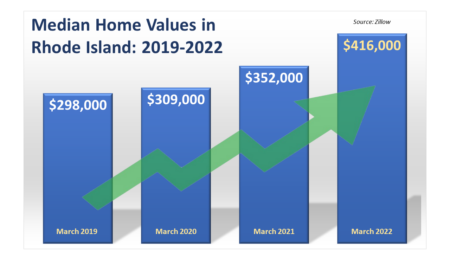

There’s no denying the real estate market in Rhode Island is hot!

According to Zillow, the median home value in RI has increased from $298,000 in 2019 to $416,000 in just three short years. So, what do you do when the house you live in doesn’t work for you and your family? Maybe it’s outdated or too small. Should you Move or Improve? When you’re asking yourself these questions, you’re really asking: Can my dislikes be changed with a remodel? Would that make financial sense?

Mary E. Noons, Executive Vice President & Chief Retail Lending Officer recently appeared on WPRI Channel 12's The Rhode Show to discuss this topic. Watch here.

Consider a Home Equity Loan or Line of Credit

Because home values have increased considerably over the last several years, you may have increased equity available to tap into which will allow you to turn your current home into the home of your dreams, without having to navigate a competitive real estate market.

- Home Equity Line of Credit (HELOC): HELOCs allow you to borrow money using the equity in your home, which is the market value of your home minus the amount you owe on it. HELOCs are a revolving line of credit, meaning you can borrow and repay funds over and again as needed during the draw period.

- Home Equity Loan: Home equity loans are fixed rate term loans in which the borrower gets a one-time lump sum. Home equity loans are paid back over a specified term (5, 10, 15, 20 or 30 years) and do not have a draw period as the home equity line of credit does.

But there are some things to consider:

- Hidden costs: No home renovation project is without hiccups, so always factor in a cushion of between 10 and 20 percent, just in case you uncover unexpected issues along the way.

Understand the risks of over-improving: There are financial risks in creating an extravagant luxury home in a mid-priced neighborhood, so be sure the improvements you want to make will add value to your home. Home improvements such as minor kitchen remodels, a new deck, or new siding and windows tend to have a better return-on-investment.

Ask Washington Trust! Our mortgage experts can meet with you to decide whether you want to Move or Improve, and most importantly, which home financing option will work best for you!

Contact a Trusted Advisor

For more information or to speak with one of our trusted advisors about your unique financial needs, contact us at 800-475-2265 or submit an online form.